lexington ky property tax bill 2020

Mortgage companies typically include an amount in the owners monthly mortgage payment to build up a reserve for paying the property tax. To use this search you must provide the Last Name of the primary owner of the vehicle and the Vehicle Identification Number VIN.

56 minutes agoWASHINGTON - House Democrats on Friday approved a sprawling bill to lower prescription drug costs address global warming raise taxes on some billion-dollar corporations and reduce the federal.

. The following are dates for the collection of the 2022 property taxes in Fayette County. If you do not have this information available please contact our Property Tax Division at 859 252-1771. In light of the ongoing COVID-19 State of Emergency declared by Governor Beshear and the effect of the State of Emergency on the operations of state and local government offices the Kentucky Department of Revenue has taken a number of steps to extend the 2020 property tax calendar.

Lexington Ky Adds More Police Downtown Amid Worries Over Crime Lexington Herald Leader It S Property Tax Time Fayette Counties Mailing Notices Abc 36 News Share this post. Newer Post Older Post Home. Search in Your County Now.

Lexington ky property tax bill 2020. The reader should not rely on the data provided herein for any reason. Different local officials are also involved and the proper office to contact in each stage of the property tax cycle will be identified.

Check the Current Taxes Value Assessments More. The County of Treasurer provides tax bill information to mortgage companies as a courtesy on their request. The median property tax in Kentucky is 84300 per year072 of a propertys assesed fair market value as.

And Missouri to the west. If you have this relationship with your mortgage company they should make the tax payment. During the tax sale the delinquent tax bills are eligible to be purchased by a third party.

The Property Valuation Administrators office is responsible for. 2022 tax bills will be mailed the last week of September 2022 and should be received by 1012022. Payment posting may take 2-4 weeks from.

Ad Register and Subscribe Now to work on your KY Tangible Personal Property Tax Return Form. Net proceeds is the amount received by the seller after all costs and expenses are deducted from the gross proceeds arising from the sale of an asset. 2139 Palms Dr Lexington Ky 40504 Realtor Com.

Lexington ky property tax bill 2020 Sunday May 8 2022 Edit. You can find all information in detail on the PVAs website. Pay at LEXserv office.

May 8 2017 1246 pm. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. Additionally you will find links to contact information.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency. On April 18 2022 the Fayette County Sheriff will turn over the unpaid tax bills to the County Clerks Office.

Maintaining list of all tangible personal property. Lexington ky property tax bill 2020 Tuesday June 7 2022 Edit. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision.

The assessment of property setting property tax rates and the billing and collection process. Ad Find Your County Property Tax Info From 2022. Lexington County explicitly disclaims any representations and warranties including without.

Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills. Online payments may be made with any major credit card Visa Mastercard American Express or Discover or by a direct debit from. Various sections will be devoted to major topics such as.

For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name. You must have your tax bill number and account number to make payment. Payments may be made online here.

Local Property Tax Rates. Their phone number is 859 254-4941.

Did Your Property Tax Bill Send You Into Sticker Shock Open Source Richlandsource Com

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

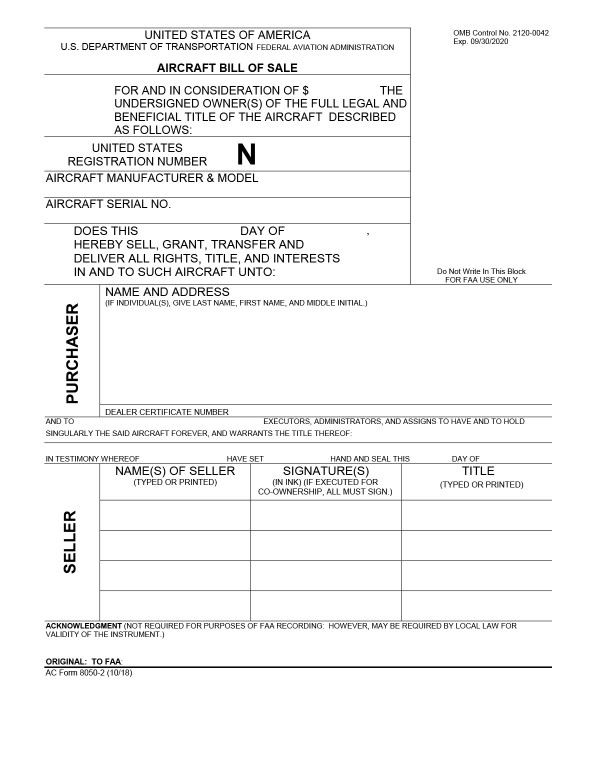

Bills Of Sale In South Carolina The Facts You Need To Know

Property Taxes In Kentucky And Fayette Co Jett Title

Laurel County Occupational Tax Office The Laurel County Occupational Tax Has A License Fee Of 1 Of Gross Payroll And 1 On Net Profits For All Work Performed In Laurel County Kentucky

Delinquent Property Tax Department Of Revenue

Ultimate Guide To Understanding South Carolina Property Taxes

And They Re Off Kentucky S Annual Real Property Tax Appeals Season Begins The First Week Of May Frost Brown Todd Full Service Law Firm

Property Tax South Dakota Department Of Revenue

Bills Of Sale In South Carolina The Facts You Need To Know

Money Saving Tips Infographic Fintrakk

Bills Of Sale In South Carolina The Facts You Need To Know

Kentucky Tax Rates Rankings Kentucky State Taxes Tax Foundation